Sales of Different Steel Products in China in the First Half of 2025

In the first half of this year, the steel market in China showed clear structural differentiation, with significant differences in sales performance among different steel products. Zhang Qiusheng, an expert at the China Metal Materials Distribution Association think tank, pointed out in an interview with China Metallurgical News that this "ice and fire" market situation is primarily due to a fundamental divergence in downstream demand.

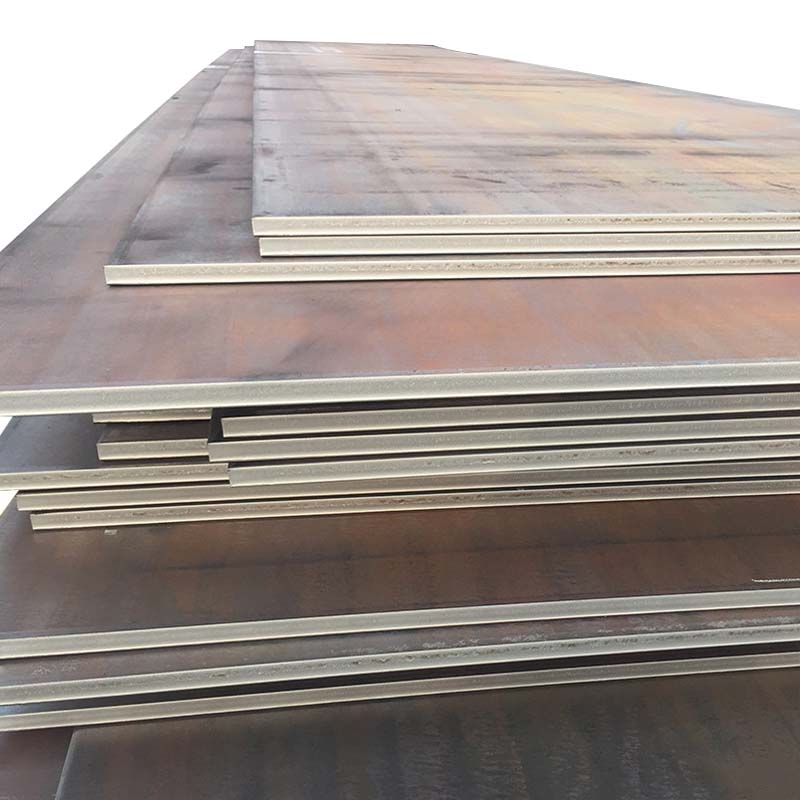

Among hot-selling products, mid-to-high-end industrial flat steel sheets performed particularly well. Benefiting from the rapid growth in new energy vehicle production and sales, the continued stimulus of the old-for-new policy for home appliance trade-ins, and the booming shipbuilding and new energy equipment industries, demand for products such as automotive and home appliance flat steel sheets, electrical steel, and high-strength steel is strong. Meanwhile, steel use in the energy sector remained stable, with seamless steel pipes such as oil well pipes and boiler tubes maintaining strong sales driven by increased investment in oil and gas exploration and the construction of thermal power projects. Furthermore, with the increasing proportion of steel structures in infrastructure projects and the advancement of green building policies, demand for structural steel is also on the rise.

However, the market for construction steel remains sluggish. Due to a sharp decline in newly started real estate construction and uneven infrastructure funding, construction steel products such as rebar and wire rod face severe challenges. Intensified market competition and persistently high inventories have further exacerbated downward pressure on prices. Ordinary medium and heavy plates and welded pipes have also performed poorly due to weak demand for construction machinery and oversupply.

Zhang Qiusheng analyzed that this divergent market dynamics is due to multiple factors. First, structural differences in downstream industry demand: the deep adjustments in the real estate sector contrast sharply with the steady growth of the manufacturing industry. Second, funding constraints have dampened consumer purchasing appetite, while supply-side adjustments have lagged behind market demand. Furthermore, market participants' concerns about future economic recovery have dampened their enthusiasm for restocking.

Looking ahead to the second half of the year, the steel market's performance will primarily depend on the effectiveness of real estate policies, the availability of infrastructure funding, the sustainability of the manufacturing industry's boom, and the degree of recovery in market confidence. Zhang Qiusheng recommends that relevant companies focus on optimizing their product mix, strengthening cost control, and implementing risk mitigation measures to navigate the complex and volatile market environment.